After Filing Your Annual Income Tax Return: Completing Your Compliance Obligations

Sumakses sa April 15 tax filing deadline? Wait! Meron pa.

Filing your Annual Income Tax Return (AITR) with the Bureau of Internal Revenue (BIR) in the Philippines is a significant step in meeting your tax responsibilities. However, for many taxpayers, especially corporations, partnerships and sole proprietors, the process extends beyond this initial submission. Several crucial post-filing requirements must be fulfilled to ensure complete compliance.

This guide will walk you through these subsequent steps:

Step 1: Preparing the Necessary Attachments to Your ITR

While the AITR itself is submitted electronically via eBIRForms or eFPS, you must separately submit specific supporting documents. A critical required attachment is the Audited Financial Statements (AFS). Annex C of Revenue Memorandum Circular (RMC) No. 34-2025 provides the below list of required attachments to your AITR, if applicable:

- Filing Reference Number (for eFiling in eFPS) or Tax Return Receipt Confirmation (for eFiling in eBIRForms)

- Proof of Payment/Acknowledgment Receipt of Payment

- Certificate of Independent CPA (BIR-accredited)

- Unaudited/Audited Financial Statements (AFS)

- Notes to the AFS

- Statement of Management Responsibility

- BIR Form No. 2307 – Certificate of Creditable Tax Withheld at Source

- BIR Form No. 1606 – Withholding Tax Remittance Return for Onerous Transfer of Real Property Other Than Capital Asset

- BIR Form No. 2304 – Certificate of Income Payments not Subjected to Withholding Tax

- BIR Form No. 2316 – Certificate of Compensation Payment/Tax Withheld

- System-generated Acknowledgment Receipt or Validation Report of electronically submitted Summary Alphalist of Withholding Taxes via [email protected]

- Duly approved Tax Debit Memo

- Proof of Foreign Tax Credits

- Proof of Prior Year’s Excess Credits

- Proof of Other Tax Credits/Payments

- BIR Form No. 1709 – Information Return on Transactions with Related Party

Ensure that all your attachments are complete, accurate, and adhere to the prescribed format. Importantly, the Statement of Management Responsibility for the ITR and AFS, as well as the Independent Auditor’s Report for the AFS, must bear the original (“wet”) signatures of the authorized signatories and the independent auditor, respectively.

Step 2: Electronically Submitting the AFS and Other Attachments to the BIR via BIR eAFS

RMC No. 34-2025 further mandates the electronic submission of the AFS and other required attachments through the BIR Electronic Audited Financial Statements (eAFS) System. This online platform streamlines the submission process.

Here’s a step-by-step guide in submitting the attachments to BIR eAFS:

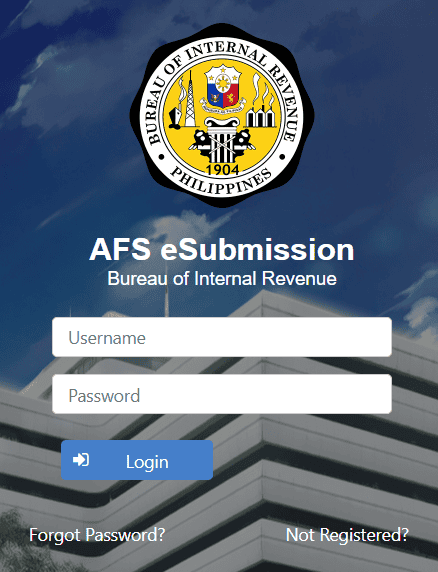

- Access the BIR eAFS System: Navigate to the official BIR website and locate the eAFS portal, or directly access it through this link: https://eafs.bir.gov.ph/eafs/

- Enroll/Log In: If this is your first time using the system, you may need to enroll your company. Otherwise, log in using your existing credentials.

- Prepare Your Files: Ensure all your AFS and other attachments are in Portable Document Format (PDF) and are not password-protected. Combine all required documents into a single PDF file, keeping in mind the maximum file size of 4.8GB. When your single PDF file is ready, you must rename it according to the BIR’s prescribed naming convention:

- File #1 (Income Tax Return):

EAFSXXXXXXXXXITRTYMMYYYY - File #2 (Audited Financial Statements):

EAFSXXXXXXXXXAFSTYMMYYYY - File #3 (Form 1709 and its attachments):

EAFSXXXXXXXXXRPTTYMMYYYY - File #4 (Tax Credits):

EAFSXXXXXXXXXTCRTYMMYYYY-XX(whereXXranges from01to99for multiple tax credit files) - File #5 (Other Attachments):

EAFSXXXXXXXXXOTHTYMMYYYY

XXXXXXXXXrepresents your 9-digit Taxpayer Identification Number (TIN).MMindicates the month-end of your taxable year (e.g.,12for December).YYYYrepresents your taxable year (e.g.,2024).

EAFS123456789ITRTY122024EAFS123456789AFSTY122024EAFS123456789RPTTY122024EAFS123456789TCRTY122024-01EAFS123456789OTHTY122024

- File #1 (Income Tax Return):

- Upload Files: Log in to your BIR eAFS account and click on the “File Upload” option on the left side of the screen.

- Specify Submission Period: In the designated dropdown menus, select “Annual (TY)” for the Period, “December (12)” for the Month, and “2024” for the Year.

- Select and Upload: For each file type (Income Tax Return, Audited Financial Statement, Form 1709, Tax Credits, and Others), click the “Choose” button and select the corresponding renamed file. Wait for each file to upload completely before proceeding to the next.

- Submit: Once all attachments are uploaded, click the “Submit” button located at the bottom of the page.

- Confirmation: Upon successful submission, you will receive a confirmation email from the BIR containing a transaction number for your record.

The eAFS-generated Transaction Reference Number or Confirmation Receipt serves as your official proof of submission. For Securities and Exchange Commission (SEC) purposes, companies should attach this system-generated receipt in place of a manual “Received” stamp.

Deadline for BIR eAFS Submission:

The deadline for submitting the AFS and other attachments to the BIR via eAFS is April 30, 2025, if the Income Tax Return (ITR) was filed on or before April 15, 2025. If the AITR was filed after April 15, 2025, the deadline is fifteen (15) days from the date of filing.

Step 3: Submitting the Audited Financial Statements to the SEC through sEC eFAST

Corporations and other entities required to submit their AFS to the Securities and Exchange Commission (SEC) must also complete a separate electronic submission through the SEC Electronic Filing and Submission Tool (eFAST).

Here’s a general process:

- Access the SEC eFAST System: Go to the official SEC website and access the eFAST portal, or click this link: https://efast.sec.gov.ph/user/login

- Enroll/Log In: If your company is not yet enrolled in eFAST, you will need to register. Otherwise, log in using your SEC-assigned credentials.

- Select AFS Form: On the left-side menu, click on “Forms” and then select “Audited Financial Statements.”

- Upload AFS Package: Upload the complete AFS package, which typically includes the:

- Audited Financial Statements (Balance Sheet, Income Statement, Statement of Cash Flows, Statement of Changes in Equity, and Statement of Retained Earnings/Statement of Comprehensive Income, if applicable)

- Notes to the Financial Statements

- Independent Auditor’s Report

- Statement of Management Responsibility for the Financial Statements

- BIR eAFS Transaction Reference Number/Confirmation Receipt

- Confirmation: Upon successful submission, the SEC eFAST system will issue an acknowledgment receipt. Ensure you keep this for your records.

Deadline and Schedules for SEC eFAST Submission:

All corporations, including branch offices, representative offices, regional headquarters, and regional operating headquarters of foreign corporations whose fiscal years ended on December 31, 2024, must file their AFS through eFAST based on the last digit of their SEC registration or license number, according to the following schedule outlined in SEC Memorandum Circular No. 01 series of 2025:

| Submission Dates | Last Digit of SEC Registration / License Number |

| May 2, 5, 6, 7, 8, 9, 12, 13, 14, 15, and 16 | 1 and 2 |

| May 19, 20, 21, 22, 23, 26, 27, 28, 29, and 30 | 3 and 4 |

| June 2, 3, 4, 5, 6, 9, 10, 11, and 13 | 5 and 6 |

| June 16, 17, 18, 19, 20, 23, 24, 25, 26, and 27 | 7 and 8 |

| June 30 / July 1, 2, 3, 4, 7, 8, 9, 10, and 11 | 9 and 0 |

It’s important to note that all corporations have the option to file their AFS regardless of the last numerical digit of their registration or license numbers before the first day of the coding schedule pertaining to their digit. Late filings or submissions after the specified due dates will be accepted starting July 11, 2025, and will be subject to prescribed penalties calculated from the last day of the designated filing period.

By understanding and meticulously adhering to these post-filing procedures after submitting your Annual Income Tax Return, you can guarantee full compliance with the regulations established by both the BIR and the SEC. Remember that timely and accurate submission is paramount to avoiding penalties and maintaining a positive standing with these regulatory authorities.

Click below link for Annex C of RMC 34-2025 and SEC MC No. 1 series of 2025 for further reference:

Stay Sharp with MSMA

Subscribe to our blog for expert tips on accounting, tax, legal insights, and business success—delivered fresh to your inbox. Once a week. No spam, just value! ✨